By means of transparent procedures, reciprocity, accuracy and agility in our relationships with clients, employees, shareholders and suppliers.

By creating opportunities and guiding the professional, material and intellectual development of our employees, always encouraging the search for cutting-edge knowledge, especially in the financial and technological areas.

By sustainably increasing the profitability of our shareholders’ capital and Brazil-China integration.

By assuming an ethical position that takes into account the dignity and wellbeing of the social groups with which we interact.

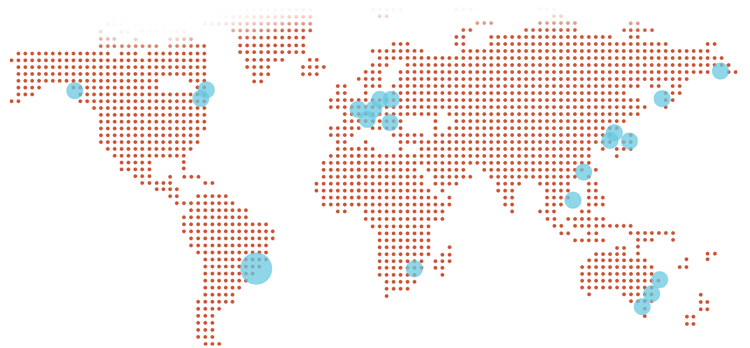

We are present in Asia, Oceania, North America, South America, Africa and Europe. A connection that links Brazil with important markets in China, Japan, Singapore, Vietnam, South Korea, Australia, the United States, Canada, the United Kingdom, Germany, Czech Republic, France, Luxembourg, Italy and South Africa.

USASan Francisco

Branch

CanadaToronto Representative Office

USANew York Branch

FranceParis Branch

BoCom (Luxemburgo) S.A.

LuxembourgLuxemburgo Branch

BoCom (Luxemburgo) S.A.

GermanyFrankfurt Branch

Czech RepublicPraga Branch

South KoreaSeoul Branch

JapanTokyo Branch

ChinaTaipei Branch

ChinaBoCom Internacional

(Hong Kong)

China BoCom

Hong Kong Branch

ChinaMacau Branch

VietnamHo Chi Minh City Branch

SingaporeSingapure Branch

AustraliaBrisbane Branch

AustraliaSydney Branch

AustraliaMelbourne Branch

ItalyRome Branch

BoCom (Luxemburgo) S.A.

South AfricaJohannesburg Branch

BrazilBanco BOCOM BBM S.A.

Sustainability, diversity, connectivity and technology are part of BOCOM BBM’s nature. These characteristics combine the values of two institutions with a long history in China and Brazil: Bank of Communications and BBM. They are also shared by our workforce of some 400 professionals, a team capable of learning from challenges, finding solutions, and leveraging knowledge. In these ways we renew and expand investment in our talent and in our relationships with people, institutions and markets. These conditions enable us to take part effectively and transparently in the endeavor to achieve society’s objectives and those of our individual and corporate clients.

We are part of a group present in Asia, Oceania, North America, South America, Africa and Europe. Integrated and connected in this way, we meet the needs of large companies established in Brazil and abroad. Guided by clear environmental, social and governance rules, we offer credit products and financial services in the segments such as Corporate, Capital Markets, Financial Products (Hedging, Forfaiting), Wealth Management, and Asset Management. We use solutions that combine concepts and techniques tested for decades while constantly adding innovations with verified efficiency.

We work with investment funds with the distinctive advantages of our vast experience in quantitative risk management, macroeconomic research, and credit analysis and monitoring. All of our qualifications and expertise are also applied in managing the wealth of individual clients with the aim of obtaining the results they desire, always in a transparent manner.

Internal changes and the transformations under way in the world act as incentives for us to grow and modernize, always oriented by our ethics and without deviating from our objectives. We follow a code of conduct based on sustainable development, social responsibility, diversity, inclusion, and transparency. These commitments guide our ESG initiatives and achievements, such as the creation of the ESG Committee and the Women’s Engagement Committee, and our support for socio-environmental and cultural projects.

Global economic growth rebounded strongly in 2021, thanks to the partial or total lifting of social isolation and similar restrictions as vaccination advanced around the world. The economic reopening favored the sectors most severely affected by the pandemic, boosting job creation and a recovery in the service sector.

Governments were able to withdraw several measures introduced as part of the fight against the pandemic, especially state monetary, fiscal and credit support in the United States, Europe, China and Brazil. However, normalization of growth rates was accompanied by inflationary pressure owing to supply chain bottlenecks and demand for energy inputs that are still required during the transition to a low-carbon economy. In response to high inflation, several countries turned to monetary tightening, and international financial conditions became more challenging as a result. The global economic recovery, in conjunction with rising prices of the commodities exported by Brazil, points to a more favorable outlook for growth in 2022, potentially reaching 1% after a 4.6% rebound in 2021. The labor market and service sector continue to recover, but a more restrictive monetary policy and a high level of household debt present challenges to growth. The reform agenda, which calls for tax and administrative reforms, among others, remains decisive for the Brazilian economic to grow robustly and achieve fiscal sustainability in the years ahead.

During the year we continued to implement the necessary procedures in our offices to protect our staff and consequently their families and friends from contamination by Covid-19. The transition to a new normal in the workplace began in the second half, through a hybrid model encouraging a return to the office while allowing people to work from home on some weekdays. In this manner we sought a balance between the need to take less time commuting and the chance to interact more with our fellow professionals.

The second half highlights include growth of our credit portfolio and presence in the corporate and sovereign bond markets, with a positive influence on our earnings and on the stabilization of the markets in which we operate. Credit portfolio expansion was partly due to our engagement in the Emergency Credit Access Program (PEAC), which enabled us both to share credit risk with the Investment Guarantee Fund (FGI-BNDES) and to lengthen the average maturity of our portfolio to match the tenor of our domestic and foreign fundraising, hence complying with the parameters of our liquidity policy.

For several reasons, the impact of the pandemic on Asian countries’ GDP growth and debt-to-GDP ratios was mitigated in the second half. The capital markets in our controlling shareholder’s region became more dynamic as a result. This competitive advantage led us to pursue opportunities and mechanisms to integrate the Brazilian and Asian markets, with China in the forefront. For example, we were the first Latin American bank to participate in Bond Connect, the main platform for foreign investment in fixed-income securities on the Chinese market.

We also strove throughout the year to optimize the use of our expertise in credit analysis and risk control generally, creating the investment funds BOCOM BBM Corporate Credit High Yield, BOCOM BBM Corporate Credit, BOCOM BBM ESG, and BOCOM BBM China. Income from these funds and other service fees totaled BRL 105 million, or 23.3% of our annual revenue in 2021.

We ended this extraordinary year feeling that we acted with efficacy and achieved positive results in a business environment that swung between extremes of pessimism and optimism. As always, we remain firmly committed to our vision and confident that our values and experience enable our team to develop innovative solutions in any context.

| Dec 18 | Dec 19 | Dec 20 | Dec 21 | |

|---|---|---|---|---|

| Total Assets | 6,298 | 8,658 | 12,215 | 14,184 |

| Capital Tier 1 | 577 | 837 | 936 | 1,013 |

| Shareholders' Equity | 601 | 653 | 764 | 841 |

| Net Income | 64 | 89 | 117 | 147 |

| Net Income before Tax | 90 | 121 | 196 | 265 |

| Total Expanded Credit Portfolio¹ | 4,408 | 6,061 | 9,383 | 10,327 |

| Total Funding | 4,897 | 6,373 | 10,549 | 11,008 |

| Return on Average Equity (p.a.) | 10.8% | 14.1% | 16.4% | 18.4% |

| Return on Average Assets (p.a.) | 1.1% | 1.2% | 1.1% | 1.1% |

| Expanded NIM (Before allowances for loan losses)²³ (p.a.) | 5.5% | 5.2% | 4.7% | 4.6% |

| Basel Ratio (Core Tier I) | 14.5% | 15.1% | 14.4% | 12.6% |

| Liquid Assets | 1,468 | 2,084 | 2,705 | 2,154 |

| Efficiency Ratio (ER) | 57.8% | 57.2% | 46.5% | 48.3% |

| Service Revenues | 64 | 88 | 105 | 139 |

| Service Revenues (% of the Total Revenues)⁴ | 21.2% | 25.3% | 23.3% | 24.6% |

1 Includes guarantees, letters of credit and operations bearing credit risk (debentures and promissory notes).

2 Includes the result of Equity Equivalence.

3 Includes services fees and adjusting for open market operations.

4 Gross Financial Income before Allowances for Loan Losses + Service Revenue + Result of Equity Equivalence.

| Domestic | Global | Brazil Sovereign Rating | ||

|---|---|---|---|---|

| Local Currency | Local Currency | Foreign Currency | ||

| Moody's | Aaa.br | Ba1 | Ba1 | Ba2 |

| Fitch | AAA(bra) | BB+ | BB | BB- |

Funds under advisory in 2021 reached:

The expanded credit portfolio at

end-2021 totaled:

Assets under management ended the year on:

Actions taken to protect our teams from contamination by Covid-19 accompanied the cycle of improvement in the pandemic throughout 2021. In the first eight months of the year, we continued to offer our people the option of working from home, and maintained the other measures implemented in 2020, starting a return to the office for all units only in September. Our actions, in conjunction with mass vaccination throughout Brazil, obtained positive results among our workforce, which totals almost 400 people.

We contributed to the education and training of professionals in the economics and technology areas via scholarships at the Pontifical Catholic University (PUC-Rio), Getulio Vargas Foundation (FGV), and Aeronautical Technology Institute (ITA).

Under the Rouanet Law, we invested in two books on subjects relevant to ESG causes: Árvores, floresta e madeira and Mulheres no Brasil. The former (“Tree, forest and wood”) discusses native species and the use of wood by society. The latter (“Women in Brazil”) shows how Brazilian women have triggered changes in the spaces they occupy.

Via the Sports Incentive Law, we supported a project called Destemidas (“Fearless Women”), which promotes wellness and citizenship in Rio de Janeiro’s Maré Community, as well as Instituto Reação’s judo classes and socio-educational workshops in Rocha Miranda, a district in the northern zone of Rio de Janeiro City.

By establishing Project WE, our Women’s Engagement Committee, we formalized our policy of stimulating a plurality of ideas and valorizing the individuality of each and every member of our staff.

A number of actions were put into practice as a consequence of Project WE, including adherence to the Corporate Citizenship Program to extend maternity and paternity leave; leadership training via a mentoring program; and a series of lectures by women with inspiring life stories. All these initiatives aim to contribute to career development for the women who work at BOCOM BBM.

The actions of our staff and our business decisions are oriented by sustainability principles, guidelines and procedures established in BOCOM BBM’s ESG policy. Our ESG principles and practices aim to have a positive social and environmental impact, mitigate environmental and social risks, and promote the wellbeing of our staff and the satisfaction of our clients, in conjunction with a sound and transparent governance structure and compliance with the applicable laws and regulations.

Escola 42 | Rio uses non-conventional methods to train people with no knowledge of computer programming to become skilled workers in the technology segment.

Arte Tech – Gamboa Ação, another technology-related project, holds weekly workshops on digital creation, English language and chess, while undertaking to make girls and boys feel at home and help them with their homework. Entre o Céu e a Favela (“Between Heaven and Favela”) offers professional qualification, cultural and sports workshops and psychosocial support for children and adolescents.

In 2021, mass vaccination against Covid-19 began in many countries around the world, while the mobility and other restrictions introduced to combat the pandemic remained in place. The major economies responded to immunization with growth. During this transition period, our expertise in extending credit was important to the process of reconstruction. We lend to three groups of companies: SME (with annual revenue of between BRL 70 million and BRL 500 million, and liquid collateral), Corporate (BRL 200 million-BRL 3 billion), and Large Corporate (more than BRL 3 billion or part of a Chinese-controlled conglomerate). We offer loans with a range of collaterals, as well as pre-shipment export finance.

We allocated BRL 2.5 billion in loans to Brazilian companies to mitigate the financial impact of the pandemic. The expanded credit portfolio totaled BRL 10.33 billion at year-end, including guarantees, letters of credit and operations with credit risk (issuance of debentures, promissory notes, Rural Product Notes (CPR), time deposits (DPGE) and foreign bonds). We prioritize transparency and agility to respond to demand for credit, financial services and derivatives in our target markets

Total Expanded Credit Portfolio

Total Expanded Credit Portfolio Breakdown by Sector

Total Expanded Credit Portfolio Breakdown by Transaction

Allowances for Loan Losses Loans and Guarantees Portfolio

Loans and Guarantees Portfolio Risk Rates

We use constantly updated tools and seek the best risk-return ratio in local and foreign investments. To assure the highest possible profitability, we offer sophisticated and efficient financial products and services in an open-platform model.

The efficiency, agility and transparency of our advisory services are the result of permanent refinement of the methods adopted in financial consultancy and exclusive fund management, taking into account all the aspects relevant to each investor. We offer personalized service and analysis considering the client’s risk tolerance, asset volume, liquidity and cash generation, to mention only a few examples.

Our professionals have solid experience in asset allocation and a long history of operating in the financial and capital markets. They are all highly trained and certified, focusing on excellence in service provision. With this expertise, we are able to make qualified and well-grounded recommendations.

Our management, dedicated to each family individually, organizes assets in the form of exclusive or restricted funds as well as direct investments by clients. Allocations are distributed among various asset types and classes. The quality of all products is assured by a rigorous process of analysis and internal approval. This approach achieves the goal of our strategy, which is the sustainable, consistent and constant growth of the client’s wealth. Assets under advisory totaled BRL 9.3 billion at end-2021.

致力于通过专属基金或直接投资的方式为个人投资者及家庭管理配置资产,为客户提供长期可持续、稳定增长的财富管理服务。采用严格的内部分析审批流程确保理财产品安全合规。截至2021年底,我行财富管理规模达到93亿雷亚尔。

Wealth Management’s Total Assets

Wealth Management Structure

Set up two years ago, BOCOM BBM Asset Management has the hallmark of our experience. The expertise of our team and the credibility of our products guarantee the quality of our service. We offer excellence of macroeconomic research, proprietary methodologies and in-house models. We use these tools to manage credit, market and liquidity risks, and for credit analysis, with the aim of achieving optimal results.

Our asset management portfolio comprises five investment funds. For investment in private credit, we have two funds with active management and different risk profiles: BOCOM BBM Corporate Credit High Yield, and BOCOM BBM Corporate Credit. Both were two years old in December 2021.

In first-quarter 2021, we added an equity fund to the portfolio: BOCOM BBM US Equities, for investment in American companies. The other two funds are BOCOM BBM ESG, a global equity fund that focuses on sustainability; and BOCOM BBM China, which invests in the stocks of Chinese companies.

By working in this manner, we are able to provide medium- and long-term returns that consistently beat the interbank deposit rate (CDI). At end-2021, we had BRL 1.1 billion under management.

We are responsible for ensuring that the bank remains liquid and for laying the basis for prices and volumes of its assets and liabilities. Via access to the capital markets, we operationalize transactions on behalf of clients, absorbing and managing the risks involved, and also exercise a mandate of generating income by actively managing market risks.

In addition, we structure and price derivatives and other products in conjunction with Corporate Credit. Our remit in this area is to present alternatives for companies to address the market risks to which their balance sheets are exposed.

We offer various types of foreign-exchange services and derivatives for hedging against the risks associated with exchange-rate fluctuation, interest-rate variation, and swings in price indices and commodity prices.

We work with Corporate Credit to identify clients who are ideally positioned to effect public issuance as a new alternative to raise capital. Our portfolio comprises multiple options in financial products and services relating to the structuring and distribution of securities and derivatives transactions.

To meet clients’ needs with quality, we offer a diversified array of activities that include participating in the preparation of documents and roadshows, as well as other investor pitching materials. We also assist clients in matters such as discussion of structures, market updates, interfacing with regulators, and retaining service providers such as legal advisors and mandated banks.

The segment rebounded in 2021. According to Anbima, the Brazilian association of financial and capital market institutions, funds raised on these markets grew 60% compared with the previous year.

Debenture issues, for example, more than doubled between 2020 and 2021, rising 109%. In this context, we ended 2021 with a total of BRL 4.269 billion in coordination of corporate bond and other securities issues, up from BRL 700 million in 2020.

Coordinated Volume DCM

DEFINITION

Credit risk is the possibility of losses associated with failure by a borrower or counterparty to honor their financial commitments on time and in accordance with contractual conditions.

OUR ACTIONS

The Credit Committee, the Board of Directors and five other areas of the bank – Credit Risk, Credit Analysis, Legal, Contract Management and Internal Auditing – constitute our framework for managing credit risk, which functions as outlined below:

Credit Risk: is responsible for monitoring, identifying, measuring, controlling and reporting credit risk, and assuring compliance with the limits set by the bank. Subordinated to the Chief Risk Officer, it centralizes and analyzes information relating to the management of individual risk per transaction and consolidated credit portfolio risk. It also shares reports to support decision-making on the credit limits approved by the Credit Committee.

The Board of Directors: approves risk management policies and limits at least once a year

The Credit Committee: sets credit limits for business groups. It is also responsible for tracking and assessing the consolidated portfolio, especially in terms of concentration and risk levels, for implementing the bank’s credit policies, and for setting deadlines for solutions to issues relating to past-due loans or to deteriorating loan security. If debt collection via the courts is necessary, for example, it decides when to file suit.

Credit Analysis: analyzes and establishes the degree of credit risk for business groups with which the bank has or plans to have credit relationships.

Legal analyzes: all contracts signed by the bank with clients, and organizes and coordinates action to collect debts and protect our rights.

Contract Control: ensures that transactions comply with the terms and conditions stipulated in the Credit Limit Proposal (CLP), that loan security is in order. It is also responsible for issuing the contracts signed by the bank with clients.

Internal Auditing: assesses and continuously monitors our business units and credit facility extension processes to make sure procedures are implemented correctly.

DEFINITION

Market risk is the possibility of financial losses to the market value of the portfolio, or of any instruments or investments, due to price or interest-rate swings. Inflation and fluctuations in stock and commodity prices are some of the key market risk factors.

OUR ACTIONS

We are pioneers of market risk quantification. In 1997, we created a proprietary system that became an industry benchmark and has since been continuously upgraded. Qualified tools and personnel identify, measure and monitor our exposure to market risk. Market Risk reports to the Chief Risk Officer and conveys all the relevant information to the Risk Committee and Executive Committee.

The market risk control framework is as follows:

The Risk Committee: analyzes and reviews risk management policies at least once a year, and proposes operational limits for market risk. It presents these proposals to the Board of Directors for approval.

Market Risk: assures correct monitoring and control of risk metrics;

Pricing is responsible: Pricing is responsible, among other things, for the pricing models and sources used to mark products to market. It does so independently of management areas.

Internal Auditing ensures that our market risk management policies are consistent and adequate to procedures.

Risk is monitored by daily calculation of Value at Risk (VaR). VaR is a statistical tool used to measure the institution’s potential loss under normal market conditions for a given confidence level and timeframe. The model for calculating VaR is regularly backtested.

The limit we set for VaR can be allocated among the many risk factors by the Chief Treasury Officer. Stress scenarios are established every quarter by the Risk Committee, with autonomy from the management areas, and these scenarios are analyzed on a daily basis by our team.

DEFINITION

Liquidity risk is the possibility of mismatched maturities, indexation mechanisms, currencies and/or values of possible payments and receivables. In practice, it is the risk that the institution is unable to honor efficiently its financial obligations, expected and unexpected, without affecting day-to-day operations and without incurring significant losses.

OUR ACTIONS

Our risk management strategy is integrated and aligned with the bank’s liquidity goal, which is to guarantee sufficient funds to honor all liabilities and commitments at any time. All decisions follow the guidelines established by the Risk Committee and approved by the Board of Directors, in accordance with the limits set by both bodies. The aim is to ensure that free cash flow will always be sufficient to support business continuity even in a situation of severe stress.

Our team centralizes and analyzes the information needed for liquidity risk management, considering a number of variables to calculate a potential future situation, such as projections for cash flow in expected scenarios and situations of financial stress, implicit risk for each client, additional funds required to settle debts, operating losses, marking to market of derivatives, and other obligations.

The main remit of the area, which reports to the Chief Risk Officer, is to assure compliance with operating limits and issue internal reports designed to contribute to decision making. As part of the process, Internal Auditing acts to guarantee the adequacy of procedures and consistency across policies and the actually implemented framework.

DEFINITION

Operational risk is the possibility of losses resulting from failure, deficiency or inadequacy of internal processes, systems or people, from fraud, or from external events. It includes legal risk, which is the possibility of problems relating to legislation or court orders that may hamper the bank’s business activities.

OUR ACTIONS

Our Operational Risk Management Policy is a document made available throughout the bank to formalize the methodology, processes, roles and responsibilities, categories, and procedures for documentation and storage of the information used to manage operational risk. Segregated from Internal Auditing and reporting to the Chief Risk and Internal Control Officer, the area is also responsible for publishing data to ensure that risk management activities are transparent. In accordance with this policy, all decision making follows best practices and complies with the applicable rules and regulations.

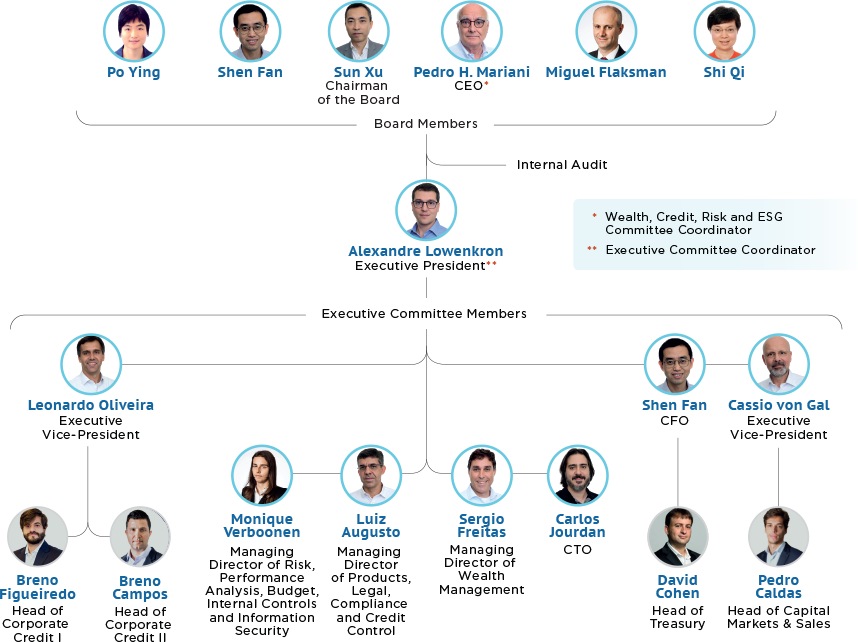

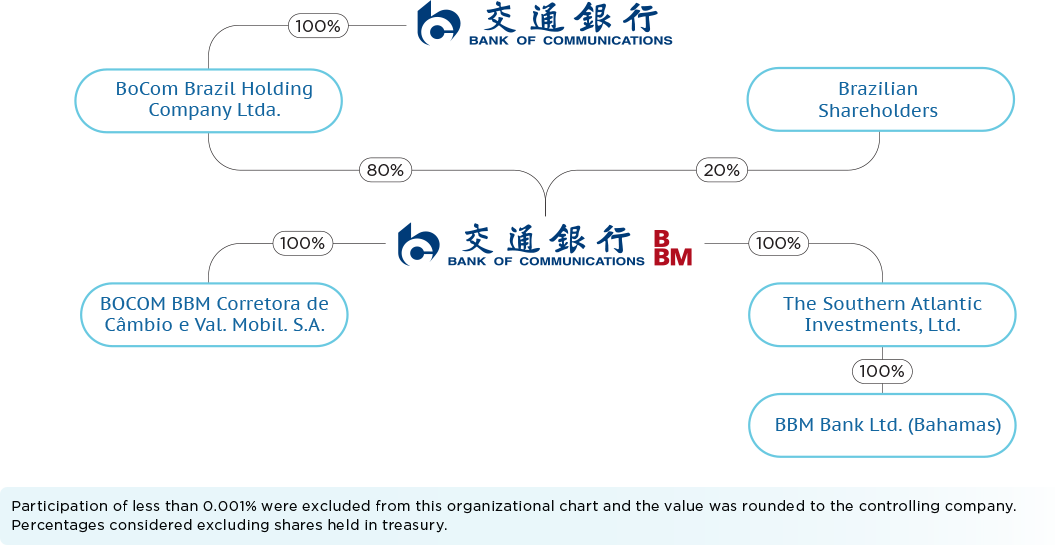

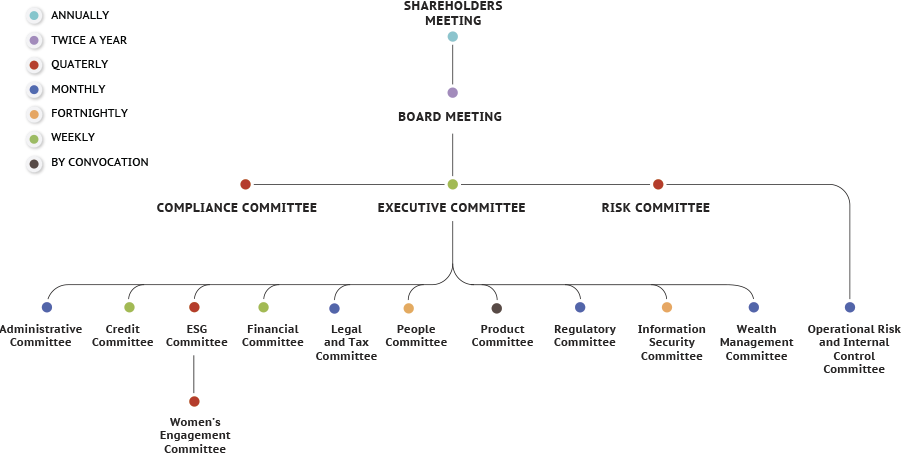

The highest decision-making body.

Members: Our shareholders.

Frequency: Meets at least once a year, and whenever convened.

Coordinates compliance with the guidelines, implements decisions by top management, tracks the bank’s performance, and decides on proposals from the specialized committees (described below).

Members: The chair of the Board, the executive directors, and the heads of Corporate Credit I & II, Capital Markets and Treasury.

Frequency: Meets every week.

Establishes the strategic guidelines for the bank’s business activities, oversees the operations of top management, and analyzes and decides on the Executive Committee’s proposals, if necessary for ratification by the shareholder meeting.

Members: Five representatives of the controlling shareholder, and one representative of the minority shareholders.

Frequency: Meets at least twice a year, and whenever convened.

The bank has 14 specialized committees for specific business and operational activities. The Risk Committee and Compliance Committee report to the Board of Directors through the Executive Committee. The others report to the Executive Committee. Our commitment to good governance, transparency and agile decision making is expressed in the form of action and composition of the specialized committees, all of which have considerable autonomy and at least two directors among their members. Board members and the CEO also participate in some of these committees.

Monitors and discusses the main sources of market, credit, liquidity and operational risk, and discusses possible adjustments. Three other important activities of this committee are analyzing and defining stress scenarios to protect the bank from sudden variations; testing and validating the quantitative models used to calculate risk factors and metrics; and deciding on matters forwarded by the Operational Risk and Internal Control Committee and the Information Security Committee.

Frequency: Meets quarterly and whenever there are significant changes for the bank and its clients.

Evaluates and monitors the annual compliance program and application of our Code of Ethics and Conduct. Periodically analyzes the compliance risks associated with our activities. Discusses and responds to the requirements of the Central Bank of Brazil, the Brazilian Securities and Exchange Commission, and self-regulating agencies. Determines guidelines for prevention of money laundering and terrorism financing.

Frequency: Meets quarterly and on demand.

Manages the budget and administrative costs.

Frequency: Meets once a month.

Establishes credit policies and approves credit limits, analyzing the financial capacity of companies that are potential borrowers and the security to be provided for such loans. Responsible for the risk-return ratio on the credit portfolio and for checking this indicator regularly to keep it positive. Uses qualitative and quantitative methods, and has recourse to a database containing information accumulated in our long experience on the credit market.

Frequency: Meets weekly, with a specific meeting at least every six months with the bank’s financial counterparties to define the maximum exposures allowed.

Analyzes and discusses the economic and financial outlook, and monitors cash flow and allocation of our assets and liabilities.

Frequency: Meets weekly.

Tracks changes to the laws and tax rules, anticipating solutions to problems. Identifies litigation and legal and regulatory discussions that impact the bank’s business, reviewing and upgrading its interpretation of changes to legislation, regulation and case law.

Frequency: Meets monthly.

Drafts, revises and enhances the bank’s people management policies. Responsible for processes of selection, recruitment, training and compensation, for example, as well as topics relating to the wellbeing of our staff.

Frequency: Meets fortnightly.

Responsible for analyzing and approving new products, and reviewing existing products, permanently examining the risks associated with them, and the legal and operational aspects of each product, while also identifying and assessing new business opportunitie.

Frequency: Meets on demand.

Tracks changes in financial and capital market regulation, and their impacts on our activities. Discusses changes and proposes measures to assure compliance with new rules.

Frequency: Meets monthly.

Responsible for managing the risks associated with information and communication technology (ICT). Analyzes possible operating incident scenarios and proposes preventive measures, reporting directly to the Risk Committee. Also handles relations with data processing and cloud computing contractors.

Frequency: Meets fortnightly.

Monitors the financial and capital markets, and discusses actions relating to wealth management for high net worth individuals, keeping all participants up to date on relevant matters affecting the business.

Frequency: Meets once a month.

Observes and discusses matters relating to operational events, and oversees operational risk management. Reports directly to the Risk Committee, and executes the action plans established by its directors.

Frequency: Meets monthly.

Suggests, implements and refines policies designed to increase the recruitment of women for all areas, pursuing gender equity in the workplace. Also responsible for implementing measures to increase the number of women in leadership roles. Reports to the ESG Committee and is not listed on the bank’s organization chart.

Frequency: Meets quarterly.

Responsible for formulating the bank’s social responsibility strategies, monitoring the activities concerned, and evaluating the bank’s ESG performance. Reviews ESG strategies, policies and targets, approves donations, and proposes actions. Reports to the Executive Committee.

Frequency: Meets quarterly.

Compliance reports directly to the Chief Compliance Officer, who is a member of the Executive Committee and has no other functions that could entail conflicts of interest, guaranteeing the area’s independence and proper authority.

In addition, the Compliance Committee reports to the Board of Directors via the Executive Committee.

With the support and involvement of top management, we work to ensure that our activities are always conducted in accordance with the highest ethical and professional standards and in conformity with the applicable laws and regulations.

To this end, our Code of Ethics and Conduct disseminates to all of our teams the four principles that orient our activities: integrity, transparency, responsibility and excellence. Full adherence to this compliance culture is reinforced by regular training sessions for all members of staff.

Our structure includes a set of policies and procedures that comply with the applicable regulations and implement industry best practices. Consistent and transparent rules and procedures establish how to prevent money laundering and terrorism financing, and to combat corrupt practices.

Risk monitoring, assessment and control are part of our governance and decision making in all areas. All our teams use risk models and parameters in such activities as calculations of economic capital, funding policy, origination, and credit portfolio management.

The guidelines, responsibilities and models used in risk management are instated by the Board of Directors, which also approves the Risk Appetite Statement (RAS), orienting and serving as a basis for our risk control policies and practices. This strategy enables us to manage our capital prudently and efficiently, in conformity with the institution’s risk appetite.

We achieve excellence in our activities by offering products with maturities that match those of our credit portfolio’s profile, alongside sound asset structuring and diversified sources of funding. This approach informs our domestic and global strategy.

In the local market, Funding and Institutional Relations works with Wealth Management to offer institutional clients (such as banks, asset managers and insurers), companies and individual investors fixed-income securities issued by Banco BOCOM BBM. The main instruments used are Certificates of Deposit (CDs), Agribusiness Credit Bills (LCAs), Real Estate Credit Bills (LCI) and Financial Bonds (LFs).

Financing and collateral operations on global markets play a complementary role in our funding activities. The quality of our international presence is assured by the support of our controlling shareholder, relationships with the world’s front-ranking financial institutions, and access to competitive rates.

The bank’s performance is reflected in the ratings awarded by two of the world’s leading rating agencies. In 2021, Fitch and Moody’s reaffirmed BOCOM BBM’s national scale ratings as AAA(bra) and Aaa.br, the highest on their respective scales; and BB+ and Ba1 on the global scale.

In sum, outstanding management in origination, asset structuring and identification of competitive funding sources enable the bank to fund and grow its activities under excellent conditions in terms of cost and tenor.

Funding by Type of Investor

Funding Sources

For decades we have unremittingly developed and applied proprietary risk management models and methodologies suited to the business environment in Brazil.

Risk control is fundamental to decision-making processes in several areas of the bank. The prudence with which it is structured assists and supports our activities. Tools and guidelines integrated with our corporate governance structure, in conjunction with our long and qualified experience in capital protection and allocation, enable us to extend credit securely and manage liquid efficiently.

We are oriented by a commitment to transparent, ethical, agile, effective and secure decision making, aligned with industry best practices and grounded in constantly updated information.

Detailed governance structureClique aqui para visualizar

Investing in the professional development of people with outstanding potential is one of our long-term strategic priorities. We pursue this objective by selecting people with material and intellectual goals that are aligned with our values.

Welcoming new talent by offering the first opportunity to those who are embarking on a career in the financial services industry is part of our history. At BOCOM BBM, new members of staff meet a team of coworkers who are highly qualified and experienced, and can help them realize their potential.

In 2021, we formalized the Women’s Engagement Committee in an initiative aimed at increasing the number of women employed by the bank and providing support for their careers.

Almost 80% of our senior executives and over half of our managers began their careers in the financial services industry at BOCOM BBM. These numbers reflect our strategy of investing in the development of our people and maintaining a transparent, dynamic and meritocratic workplace.

We offer concrete opportunities for professional growth. Compensation includes a semiannual variable bonus based on an assessment process that balances individual and collective performance, ensuring that personal growth keeps pace with the bank’s long-term results. Executives and managers orient the process, keeping a close eye on the progress of each individual member of their teams. All actions are aligned with our Code of Ethics and Conduct.

As part of our strategy in selecting the most talented people and forming excellent professionals, we partner with the best universities in Brazil. Close contact with the academic community enables us to award scholarships to monitors, undergraduates and master’s degree candidates in some of the foremost centers of learning and research. We continuously encourage staff to develop professionally and academically via our People Policy, offering financial support and flexible hours to permit a work-study balance so that our people can seek additional qualifications and knowledge by enrolling in courses and graduate programs.

We also sponsor events such as conferences, trade shows, and hackathons with programmers to foster software development.

Professional Growth

Academic Profile

Distribution of resources available for investment in different assets in order to obtain the highest possible return with the lowest possible risk.

Cash and cash equivalents, repos, interbank deposits, foreign exchange and marketable government bonds.

Procedure to validate financial models based on their past performance. In this manner it is possible to determine how well a given model would have performed in the past as a basis for predicting its future performance.

Compound Annual Growth Rate, an indicator used to estimate the average return on an investment in a specific period.

Cash equivalents/Investments that can be readily converted to cash such as commercial paper, marketable securities, money market holdings and other highly liquid assets.

Demand and time deposits, interbank deposits, bank bonds (LFs), agribusiness credit bills (LCAs), real estate credit bills (LCIs), foreign borrowings, and pre-export finance.

Loans and securities with credit risk such as debentures, promissory notes or farm produce bonds (CPRs).

Chief Executive Officer, the person with the highest authority at the top of the organization’s hierarchy.

Short-term negotiable debt instruments issued by financial institutions that promise to pay the bearer or registered owner a fixed or floating rate of interest.

CDIs are fixed-income securities issued by financial institutions for mutual lending purposes, usually overnight.

Being in compliance means acting in conformity with laws, regulations, policies and guidelines, thus guaranteeing ethical and transparent conduct.

Control of investors’ profiles to ensure that requested investments in financial assets are compatible with their objectives and risk tolerance.

Medium- to long-term debt instruments that pay a fixed rate of interest and make the holder a creditor of the issuing company.

(Risk Appetite Statement – RAS)

A RAS formaliza os tipos de riscos aos quais a instituição está exposta ao realizar suas atividades, bem como o seu apetite a cada um desses riscos. O objetivo é estabelecer um processo de governança eficaz, de forma a alinhar os interesses da instituição com os riscos efetivamente praticados.

Financial instruments whose value derives from an underlying asset, reference rate or market index.

Type 1 | Forwards: over-the-counter contracts between two parties to buy or sell a specified quantity of a commodity or financial asset at a price agreed in the present but for settlement on a future date. May entail periodic adjustments.

Type 2 | Futures: exchange-traded contracts that obligate the parties to transact an asset at a future date and price. Settlement may be by physical delivery or in cash. Both parties must post margin throughout the life of the contract as the price varies.

Type 3 | Options: exchange-traded contracts giving the buyer the right but not the obligation to buy or sell an asset or instrument at a fixed price prior to or on a specified date. The option buyer pays the writer (seller) a premium.

Type 4 | Swaps: over-the-counter contracts between two parties to exchange financial instruments, yields, rates or payments for a certain time.

A debt instrument with a subordination clause, meaning that in the event of the issuing institution’s liquidation or bankruptcy the holder will be paid only after all other creditors have been paid.

The Portuguese-language acronym for Time Deposit with Special Collateral, a type of CD (certificate of deposit) issued by financial institutions for funding purposes. Commercial banks, full-service banks, development banks, investment banks, credit associations (SCFIs) and savings and loan associations are authorized by law to issue DPGEs, which are guaranteed by the FGC deposit insurance fund.

Active management of an investment fund aims to assure a return higher than a specified benchmark. To achieve this objective the fund manager analyzes assets and selects those considered suitable for investment by the fund.

Index that measures the degree of leverage of a financial institution.

Fixed-income debt instruments issued by financial institutions to fund loans to agribusiness.

Fixed-income debt instruments issued by financial institutions to fund loans to the real estate, housing and construction industry.

LFs are designed to extend the maturity of financial institutions’ funding profiles. They can be issued for at least two years by universal banks, commercial banks, development banks, investment banks, credit and investment societies, savings banks, mortgage companies, home loan societies, and BNDES, the national development bank. They can be linked to inflation or pay a fixed interest rate at least semiannually.

All limits to which the institution is subject in order to comply with regulatory requirements and internal policies.

Repurchasing agreements structured as bond sales, with an agreement to repurchase the debt security in a future date at a higher price to factor in the dealer’s interest expense. Equivalent to a secured deposit.

Also known as multilateral institutions, these are entities established by the world’s leading nations to work together for the full development of political and economic activities, health, security and infrastructure. Examples include the UN, WHO, IDB, IFC, Proparco, and DEG.

Debts and obligations of the business recorded on the right side of the balance sheet, including accounts payable, deferred revenues and accrued expenses, for example.

Allowance for Loan Losses is a balance sheet account that represents a bank’s best estimate of future loan losses due to client delinquency and default.

This is an indicator that measures a firm’s capacity to add value from its own resources and investor funds, based on net income as a percentage of average shareholders’ equity over a period (typically two years).

| Liabilities | Prudential Conglomerate | |

|---|---|---|

| 12/31/2021 | 12/31/2020 | |

| Current and noncurrent liabilities | 13,323 | 11,431 |

| Deposits | 2,236 | 2,802 |

| Repurchase agreements | 1,732 | 291 |

| Interbranch accounts | 32 | 60 |

| Borrowings | 4,663 | 3,463 |

| Funds from acceptance and issue of securities | 3,566 | 3,816 |

| Subordinated debt – LF | 206 | 202 |

| Derivative financial instruments | 318 | 371 |

| Other liabilities | 559 | 411 |

| Allowance for financial guarantees | 11 | 15 |

| Deferred income | 20 | 20 |

| Equity | 841 | 764 |

| Total liabilities and equity | 14,184 | 12,215 |

| Assets | Prudential Conglomerate | |

|---|---|---|

| 12/31/2021 | 12/31/2020 | |

| Current and noncurrent assets | 14,139 | 12,178 |

| Cash and cash equivalent | 973 | 667 |

| Short-term Interbank investments | 411 | 769 |

| Marketable securities and detivative financial Instruments | 4,742 | 3,707 |

| Interbank accounts | 7 | 64 |

| Loan transactions | 8,048 | 6,994 |

| Allowance for loans | (53) | (39) |

| Permanet assets | 11 | 16 |

| Permanente | 45 | 37 |

| Investments | 1 | 1 |

| Property and equipment in use | 11 | 11 |

| Intagible assets | 32 | 25 |

| Total assets | 14,184 | 12,215 |

| Income Statement | ||

|---|---|---|

| 12/31/2021 | 12/31/2020 | |

| Financial income | 862 | 887 |

| Financial expenses | (434) | (540) |

| (Provisions) of allowance doubtful accounts | (15) | (27) |

| Gross financial income | 413 | 320 |

| Service revenues | 139 | 105 |

| Personnel expenses | (112) | (90) |

| Other administrative expenses | (71) | (61) |

| Tax expenses | (28) | (24) |

| Other operating income (expenses) | - | 3 |

| Operating Income (loss) | 342 | 253 |

| Non-operating income (expenses) | (1) | (7) |

| Income before taxes on income and interests | 343 | 246 |

| Income and contribution taxes | (118) | (79) |

| Interest of directors and employees profit sharing | (78) | (50) |

| Net income | 147 | 117 |

| Comprehensive income | 117 | 143 |